Not All Private Credit Is Created Equal

Since the global financial crisis, assets in private credit have grown exponentially as investors search for yield while protecting against inflation and rising interest rates. Once a small corner of the investment universe, private credit has boomed into a major asset class that does not appear to show signs of slowing. Over the 2010-2020 period, assets have exhibited a 12.8% compounded annual growth rate.[1] However, not all private credit is created equal. We believe the private credit landscape is quite diverse relative to its publicly traded counterpart, and investors should take time to fully understand the differences within the space.

Share

Ways to Categorize Private Credit

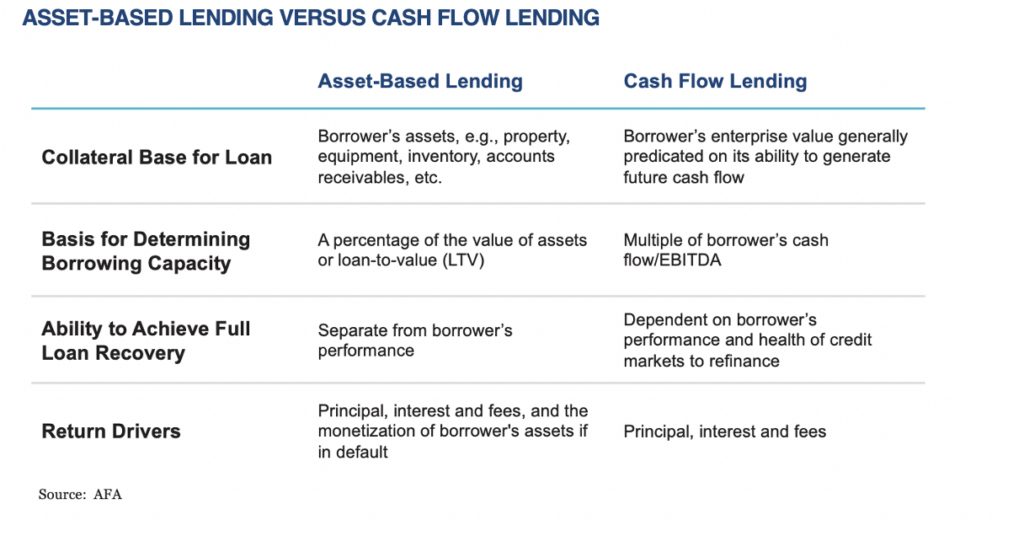

Investors have a multitude of ways to categorize corporate private credit utilizing common terms familiar to public investors—sector, borrower credit quality, duration, etc. However, at AFA, we believe that this type of categorization is only one level of diversification within private credit. We believe an important distinction in corporate private credit is the lending type: Asset-Based or Cash Flow–Based. In our opinion, this comparison provides a better framework for evaluating diversification within the asset class because the stark differences in underwriting and servicing between the two lead to different outcomes on the downside.

Cash flow lending (CFL) uses a borrower’s enterprise value as collateral and their cash flow to determine the loan amount and terms. These loans may or may not have covenants, which protect the lender to minimize losses when the borrower undergoes stress. Generally, though, in the case of a default, the lender must work with the borrower to recoup as much of the value of the company as possible, typically through long and complex bankruptcy proceedings.

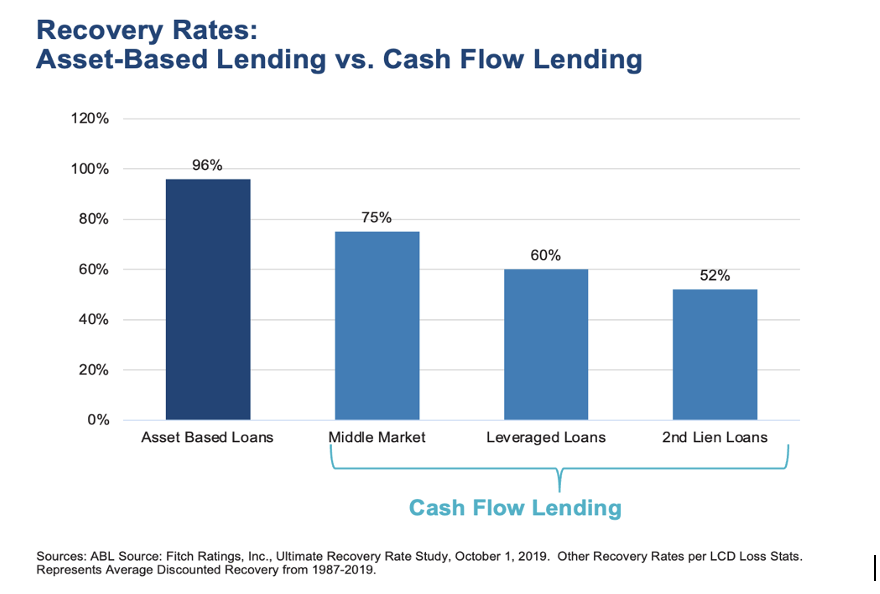

Asset-based lending (ABL) uses specific borrower assets as collateral, such as property, inventory, and equipment, and the loan amount and terms are based on the value of that collateral. The lender will value the asset on a standalone basis and then advance a loan in an amount less than that value. These loans have covenants that give lenders the right to assume ownership of the collateral in the case of a default, drastically reducing the timeframe and uncertainty around recoveries.

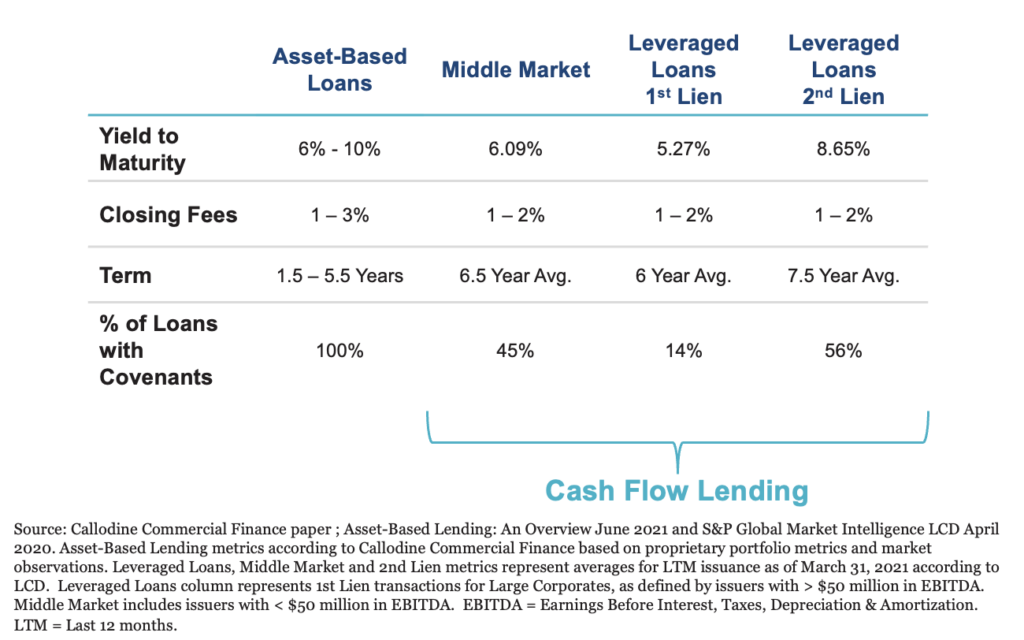

So why do we at AFA view the private credit space through this ABL vs. CFL lens? Private credit is a great way to achieve strong returns, but just as importantly, an allocator needs to consider what their risk is, especially if there is little historical return data available for the asset. Looking under the hood at a loan structure provides a great lens for identifying the risks and return drivers. We believe ABL’s strong protection via covenants, focus on asset value in the event of default, and ability to segregate the assets from the business during bankruptcy all bode well for the lending type in a downturn. Because of this, we believe ABL is the optimal choice for private credit investing when considering the level of returns per unit of risk.

Loan Features: Asset Based vs Cash Flow Based

So why doesn’t every lender employ an ABL strategy? It is much more difficult to source loans in the ABL market, whereas the CFL market has a continual source of supply from the private equity market. ABL requires more monitoring bandwidth, as the lender must continually re-evaluate the underlying asset to evaluate compliance with the covenants and perfection of the lien. Lastly, the underwriting process is often more difficult, since the loan terms and covenants must be tailored to the specific underlying asset rather than a cookie-cutter template.

Closing Thoughts

An allocator may still choose to allocate to a CFL strategy if they are confident with the lender’s underwriting standards and the yield they are receiving. But as we know, the only “free” lunch in the investment business is diversification, so we would recommend pairing an ABL strategy with the CFL position. Since ABL provides similar yields as CFL, there may not be any give-up in those benefits. But, if defaults and bankruptcies were to rise, ABL might be a more stable position in that environment. There is also the opportunity for ABL investors to benefit from higher returns from a liquidation of collateral, which is not the case for CFL.

Thanks to the private credit markets, investors now have access to attractive yields with potentially lower interest rate and inflation risk. But, as investors start to allocate to the space, they must navigate carefully, given how newly developed it is and how little historical data there is to properly evaluate the risks, especially during this goldilocks period for credit. By focusing on risk from the perspective of loan structures and collateral, an allocator can better model how an allocation to this asset may complement a traditional investment portfolio and set expectations should the credit cycle take a turn.

Disclosures

Past performance does not guarantee future results. Index performance is not indicative of fund performance. To obtain fund performance click here.

Investors should carefully consider the Fund’s investment objectives, risks, charges, and expenses before investing. This information is included in the Fund Prospectus and a copy may be obtained by calling 800-452-6804 or by contacting us here. Read the prospectus carefully before you invest.

Special risks associated with investments in bank loans and participations include (i) the possible invalidation of an investment transaction as a fraudulent conveyance under relevant creditors’ rights laws, (ii) so-called lender-liability claims by the issuer of the obligations, (iii) environmental liabilities that may arise with respect to collateral securing the obligations, and (iv) limitations on the ability of the Fund to directly enforce its rights with respect to participations. Successful claims in respect of such matters may reduce the cash flow and/or market value of the investment. In addition to the special risks generally associated with investments in bank loans described above, the Fund’s investments in second-lien and unsecured bank loans will entail additional risks, including (i) the subordination of the Fund’s claims to a senior lien in terms of the coverage and recovery from the collateral and (ii) with respect to second-lien loans, the prohibition of or limitation on the right to foreclose on a second-lien or exercise other rights as a second-lien holder, and with respect to unsecured loans, the absence of any collateral on which the Fund may foreclose to satisfy its claim in whole or in part. In certain cases, therefore, no recovery may be available from a defaulted second-lien loan. The Fund’s investments in bank loans of below-investment-grade companies also entail specific risks associated with investments in non-investment grade securities.Diversification does not assure a profit or protect against loss in a declining market.

Foreside Financial Services LLC is the Fund’s Distributor.