In the Land of Fixed Income, We Believe Yield Is King

Share

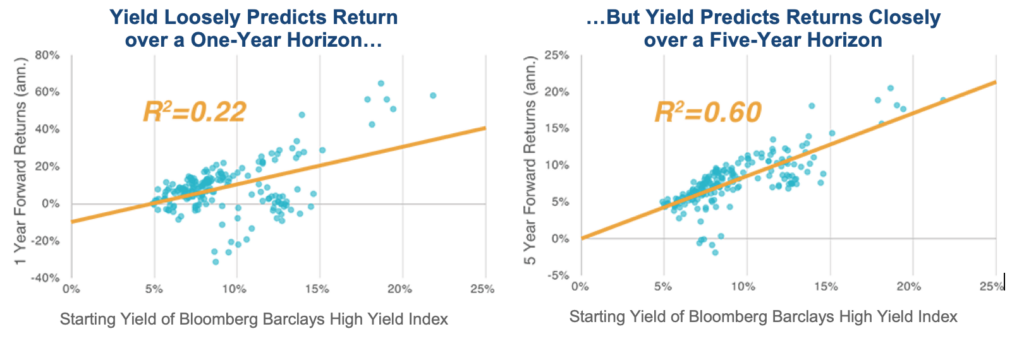

The Power of Starting Yield

Spreads widen and tighten and Treasury yields rise and fall, but these movements tend to merely provide noise and rearrange the return stream, either pulling forward returns or pushing them out. For example, a decline in Treasury yields in year one provides strong returns for that single year, but also leads to lower returns in years two through five as yield has declined. Consequently, over a multi-year time period, we believe yield is king.

Source: Bloomberg, AFA Calculations. Yield data from January 2000 through August 2016. Returns data from January 2000 through August 2021. R-squared is a measure of the strength of the relationship between two variables. A higher number indicates a strong relationship. The orange line in the above graphics represents best fit calculated via regression analysis. Data points surrounding this line are represented by the blue dots.

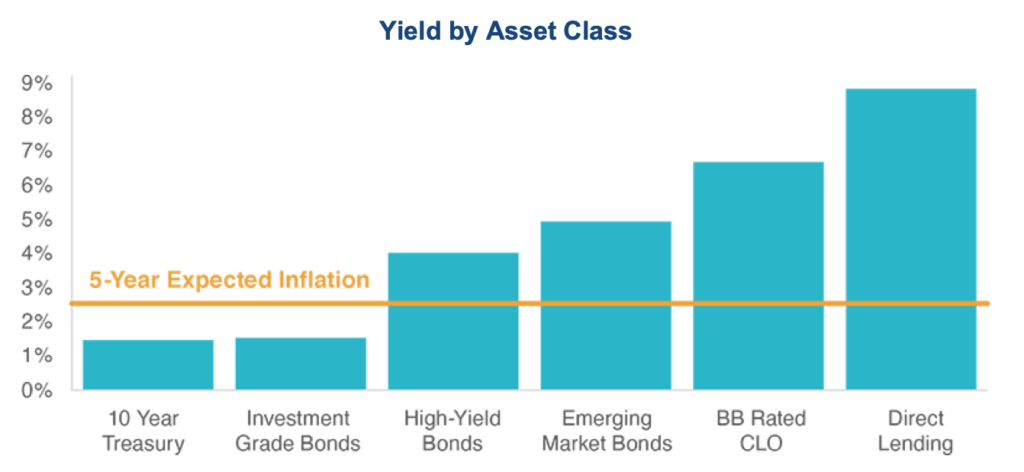

Implications for Portfolio Construction

The conclusion for portfolio construction becomes readily apparent: focus on yield to boost fixed income returns. Mark-to-market gains and trading alpha are certainly important return components. However, yield tends to be the ultimate arbiter of outperformance over long periods of time. This does not mean that lower-yielding sectors of the fixed income market are obsolete. Rather, portfolio managers should align return expectations in a low-rate environment.

Lower-yielding fixed income can be a portfolio diversifier—but higher-yielding assets can potentially enhance portfolio returns.

Source: Bloomberg, AFA as of 8/31/2021. Investment-Grade Bonds = Bloomberg Barclays US Aggregate Bond Index, High-Yield Bonds = Bloomberg Barclays High Yield Index, Emerging Market Bonds = JPMorgan EMBI Core Index, BB-Rated CLO = discount margin on the BLO BBB-rated tranches of the Palmer Square Debt Index plus 3-Month ICE LIBOR, Direct Lending = annualized income return on the Cliffwater Direct Lending Index as of the most recent quarter, 5-Year Expected Inflation = Treasury inflation-protected security breakeven rate.

Closing Thoughts

At AFA, our philosophy is to build portfolios with a notable yield advantage against traditional fixed income markets while simultaneously controlling risk to prevent market events from eroding that yield advantage. This is significantly easier with the flexibility to allocate into less efficient pockets of the private markets because factors like illiquidity, sourcing, and complexity may add additional yield. This yield advantage is no guarantee the portfolio will outperform liquid markets in short periods of time. However, we believe it provides a meaningful competitive advantage over intermediate- and longer-term time horizons.

Disclosures and Index Definitions

Past performance does not guarantee future results. Index performance is not indicative of fund performance.

Investors should carefully consider the Fund’s investment objectives, risks, charges, and expenses before investing. This information is included in the Fund Prospectus and a copy may be obtained by calling 800-452-6804 or by contacting us here. Read the prospectus carefully before you invest.

Investments in debt securities typically decrease when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower rated and non-rated securities present a great risk of loss to principal and interest than higher rated securities.

Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. It includes Treasuries, government-related and corporate securities, MBS (mortgage backed securities: agency fixed-rate pass-throughs), ABS (asset-backed securities) and CMBS (commercial mortgage-backed securities: agency and non-agency). Bloomberg US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. JPMorgan EMBI Core Index is a broad, diverse U.S. dollar denominated emerging markets debt benchmark that tracks the total return of actively traded debt instruments in emerging market countries. Palmer Square Debt Index is a rules-based observable pricing and total return index for CLO debt for sale in the United States, rated at the time of issuance as AAA or AA (or an equivalent rating). Cliffwater Direct Lending Index seeks to measure the unlevered, gross of fee performance of U.S. middle market corporate loans, as represented by the asset-weighted performance of the underlying assets of Business Development Companies (BDCs), including both exchange-traded and unlisted BDCs, subject to certain eligibility requirements.